Warren Buffett’s 25 biggest mistakes – and 4 lessons they teach

Unlike many investors, he admits and mostly corrects his errors. He discerns two types; knowing their differences can spare you much grief. Sometime in the mid-1990s (I recall vaguely but can’t find the quote), Alan Cameron, who at that time headed the Australian Securities Commission (ASIC’s predecessor), defined an experienced investor as one who accumulates […]

How you – and managed funds – overstate your returns

An investment’s average result ALWAYS exceeds – often greatly – its most likely result. I explain how and why, and what you can do about it. Most Investors and Traders-Speculators Underperform It’s long been widely known: the long-term returns of most managed investments fail to match – never mind exceed – benchmarks such as the […]

Why Australian equities will again outperform

Their earnings have sunk since the GFC, yet even weaker bases underpin the S&P 500’s returns. Aussie stocks thus offer better prospects. Overview Over the past decade and more, the total (incorporating the reinvestment of dividends) returns of the All Ordinaries and S&P/ASX 200 indexes have underperformed the S&P 500 Index. According to Roger Montgomery, […]

How experts’ “systematic mispredictions” improve our returns

Their forecasts lure most investors into overconfidence – and thus losses. If you recognise experts’ biases, you can grasp opportunities. Preview A week, it’s often been said, is a long time in politics. If so, a couple of days can be an eternity in financial markets! On 2 August, a journalist in The Australian (“Markets find ‘sweet […]

Investors, prepare: Australia will abandon its emissions targets

Its power transition is fading, its energy transition is fiction, net zero is fantasy – and politicians’ transition to reality has begun. The mainstream media’s coverage of “climate and energy policy” (the Albanese government has yoked the latter to the former) is grossly unbalanced. Whether it’s The Australian or Guardian Australia, reports are slanted overwhelmingly towards governments’ aspirations […]

Trump will likely win – but won’t make America great again

He’ll likely win because the U.S. is in a very bad way; but whoever wins will probably fail because what’s undiagnosed remains untreated. Donald Trump will likely defeat Joe Biden at the American presidential election on 5 November. One major reason is well-known but not, in some mainstream media outlets, widely-publicised: for the past several […]

Is the consensus herding you towards hefty losses?

Next year’s estimated earnings massively exceed today’s actual earnings, and the market’s P/E is sky-high. They augur much lower returns. “There has been a positive start to the year for Australian corporate earnings estimates,” reported The Australian on 2 February. It quoted the head of Australian equities research at a global investment institution: “I think what’s happening […]

Does Dow 40,000 Vindicate Dow 36,000?

The book’s premises are false and its forecasts have been wildly inaccurate. By exposing its flaws I reconfirm some basics of investment. This year marks the 25th anniversary of James Glassman’s and Kevin Hassett’s book Dow 36,000: the New Strategy for Profiting from the Coming Rise in the Stock Market (Random House, 1999). It didn’t merely contend that […]

Why we mostly ignore market sentiment

Changes of sentiment don’t cause markets to ebb and flow; but their short-term fluctuations, which are largely random, affect sentiment. “So far, so good!” Ken Fisher recently exulted (“To forecast financial markets, get sentimental,” The Australian, 16 April). “My 2024 outlook (issued in January) called for strong gains down under and worldwide – but with Aussie […]

“Net zero” isn’t a Megatrend: It’s a Mega-trap

The “transition to net zero” isn’t happening and “green energy” has long generated red ink. When will the herd finally acknowledge reality? “Investors can’t ignore a megatrend that’s transforming consumer, corporate and government behaviour worldwide,” Michelle Lopez asserted three years ago (see “The energy revolution is happening whether we want it or not,” 10 May […]

Everything the mainstream says about earnings is wrong

“Experts” obsess about irrelevancies, overlook what’s crucial – and are once again prodding the herd towards the risk of large losses. It’s “an article of faith among Wall Street research departments,” wrote David Dreman in Contrarian Investment Strategy (1979): “Nothing is as important in the practice of security analysis as estimating the earnings outlook.” Whether for individual […]

Stock tips are for patsies – are you a patsy?

Overview “Mr Market is there to serve you, not to guide you,” wrote Warren Buffett in his letter to Berkshire Hathaway’s shareholders in 1987. “If he (is) … in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under […]

Do earnings drive stocks’ returns?

Investors greatly overstate the short-term effect of earnings and ignore the long-term impact of dividends. The implications are momentous. Overview Mainstream financial media, as well as professional and retail investors, obsess about corporate earnings and their near-term prospects. The fixation is constant, but it’s most intense during “earnings season.” The media encourage investors, and investors […]

Why the S&P 500’s Five-Year Prospects Are Poor

Its valuation is unappealing and it’s extremely top-heavy. If these variables revert to historical means, investors will sustain losses. “At times,” reckons Richard Saintvilus (“Trusting the Magnificent Seven Stocks,” Nasdaq.com, 14 November 2023), “it can be a struggle to believe in the overall direction of the stock market, particularly as uncertainty remains with regards to interest […]

Which are Riskier: stocks or bonds?

The answer has varied over the past 150 years; it also depends upon the CPI. Are investors now underrating both asset classes’ risks? It’s one of the most basic questions that investors face. Which are riskier: stocks or bonds? The answer is crucial because, as AQR put it (“A Changing Stock-Bond Correlation: Drivers and Implications,” […]

Dividends aren’t a bane – they’re a boon

Payouts aren’t merely sensible, they’re desirable: by boosting subsequent earnings, they improve companies’ and thus investors’ returns. Should dividends be “the bane of your investment life”? Does Australia’s system of dividend imputation “force companies to behave irrationally” – that is, pay overly generous dividends, retain insufficient earnings, restrict capital expenditures and cause shareholders’ long-term returns […]

Index funds’ key flaws – and how we overcome them

For some investors, long-established and low-cost active funds are likely a better option than many index funds and most ETFs. Without resorting to Google, try to guess who said this: “if everybody indexed, the only word you could use is chaos, catastrophe. The markets would fail.” It’s none other than John Bogle! Long known and […]

A contrarian assessment of Macquarie Group

The crowd lauds its strengths but ignores its structural weaknesses and ethical shortcomings. I assess both and consider their implications. During the long stretches outside crises, bear markets, panics, recessions, etc., Leithner & Company constantly seeks suitable candidates for investment – and when we find them, we research them thoroughly. The minority of contenders which […]

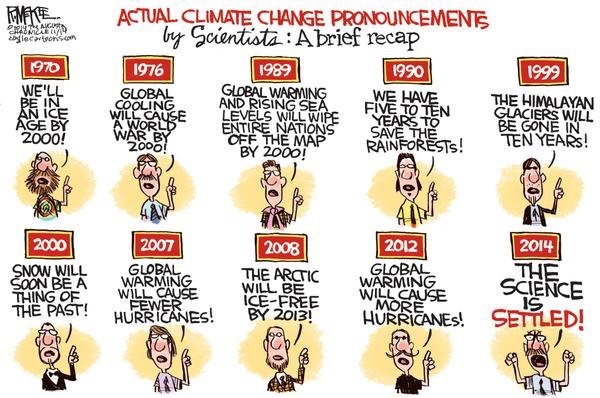

Why value investors should doubt “climate science”

By nature they’re sceptics, and at key junctures become contrarians. I show why they should disbelieve the orthodoxy – and why it matters. The drumbeat has long been incessant, and lately it’s become deafening. For years, “the consensus” has decreed that “the science is settled.” And on 27 July, the UN’s Secretary General, António Guterres, […]

How we prepare for – and profit from – recessions

We’ve outperformed over the long term by being conservatively contrarian during booms and aggressively contrarian during busts. Investors must never forget: the economic cycle includes contraction as well as expansion. Downturns usually don’t last nearly as long as upswings, and since the Second World War they’ve become even less frequent. Perhaps that’s why, as it […]

Are Australia and the US heading for severe recessions?

Their money supply’s shrinking and yield curves have inverted. This confluence of events always precedes slumps; can this time be different? In “Dude, Where’s My Recession?” (The New York Times, 14 July) Paul Krugman noted: “almost a year has passed since the U.S. Bureau of Economic Analysis, which estimates gross domestic product, announced that real […]

The Myth of Small-Cap Outperformance

“Investing” in Aussie small-caps is like gambling: the longer you play and the bigger your bet, the more you’ll underperform the house. “Small-cap stocks tend to outperform big-caps,” asserts Investopedia (“Understanding Small-Cap and Big-Cap Stocks,” 4 August 2022), “ … because they are able to grow more rapidly than larger companies.” It’s an oft-made claim. […]

How Canberra’s finances have worsened – and why it matters

Analysis of its monthly financial statements since 2005 uncovers trends that commentaries about its annual budget downplay or overlook. For more than 20 years, it’s been a basis of Leithner & Company’s operations: as a conservative-contrarian value investor, we think for ourselves – and thus always discount and often reject conventional opinion and behaviour. Warren […]

Why America’s now in recession – and what it means for Australia

Leading indicators, weekly earnings and hours worked, GDI and productivity are all falling. That’s bad for Aussie as well as U.S. equities. In Should we be in a recession already? (2 June), Roger Montgomery wrote: “given the slumping credit demand and tightening lending standards in the U.S., which typically precede or accompany a recession, one wonders why […]

Is Australia Risking a Debt Crisis?

Probably not – but high and rising debt will boost CPI and interest rates, and stifle GDP growth and investors’ returns. In America’s real debt crisis (15 May), I wrote: “The choice is stark: Americans must either undertake radical budget reform and (public) debt deleveraging, or accept continued economic stagnation – and if current trends worsen, eventually […]

America’s real debt crisis

The exponential rise of debt is stifling its economic growth. It thus takes ever more dollars of debt to generate an extra $1 of GDP. In Fortune magazine on 22 November 1999, Warren Buffett recounted to Carol Loomis: “Someone once told me that New York has more lawyers than people. I think that’s the same fellow who […]

Does the RBA’s “negative equity” matter?

It admits it owes more than it owns, and if it were a company it’d be bankrupt, but insists this doesn’t matter. I’m sceptical. In Why the RBA should be abolished – and what could replace it (10 April) I demonstrated that, for more than a century, central banks haven’t fostered stability. Quite the contrary: they’ve created […]

Why the RBA Should Be Abolished – and What Could Replace It

Central banks’ inflation destroys currencies and worsens the boom-bust cycle. Milton Friedman reckoned that computers would do far better. In What Causes – and How to Prevent – Bank Crises (27 March), I showed that there’s a straightforward way – which entails no change of legislation or regulation – virtually to eliminate the probability that a bank […]

What Causes – and How to Prevent – Bank Crises

Duration mismatch regularly causes some banks to fail. Matching the duration of short-term assets and liabilities will eliminate failures. In my previous wire (The Risk of Higher Rates the RBA’s Overlooking, 21 March), I noted that the failures of the crypto-friendly Silvergate Bank and the tech-centric Silicon Valley Bank (America’s 16th-largest), as well as the […]

The Risk of Higher Rates the RBA’s Overlooking

Its policy rate is well below the Fed’s. That can’t last: the RBA can’t indefinitely fight and must ultimately follow the Fed. In a recent wire, I substantiated my doubts that central banks in Australia and the U.S. will be able to return the genie of consumer price inflation to its bottle (their targets) as […]

Why Australia won’t become a “renewable energy export superpower”

To sustain their grids, world leaders of “renewables” import power. Australia can’t, so it’s either fossil-fuelled backup or blackouts. In a joint media release with Victoria’s Minister for Climate Change and Energy (note the order of the words, which seems to reflect their order of importance to the state government) on 19 December, Chris Bowen, […]

Farewell low “inflation” and interest rates?

Investors are assuming the “Great Moderation” remains intact. But the tectonic plates are shifting – and bode ill for long-term returns. On 7 February, Jerome Powell, the Chairman of the Federal Reserve’s Board of Governors, summarised the challenge confronting central bankers in the U.S., Australia and elsewhere: “We have a significant road ahead to get […]

“Global Energy Transition” – Fact or Fiction?

Most believe that it’s a fact, but they’re ignoring or denying data. An examination of these data demonstrates that it’s mostly fiction. “Energy transition,” said S&P Global in 2020, “refers to the global energy sector’s shift from fossil-based systems of energy production and consumption – including oil, natural gas and coal – to renewable energy […]

Will 2023 be beautiful or ugly?

Will 2023 be “beautiful” (as Ken Fisher asserts) or ugly (as Harvard professor and former IMF chief economist Kenneth Rogoff fears)? “After 2022’s woes,” says Ken Fisher (“Big Year for Stocks, Bonds,” The Australian, 16 January), this year “markets are primed for beautiful gains. Last year’s fear fest and global bear market has many (people) dreading […]

Why fossil fuels are ethical and their opponents aren’t

Taking into proper consideration advantages and benefits as well as costs and disadvantages, any conventional investment portfolio shouldn’t merely consider fossil fuels, their producers and consumers; they should underpin any portfolio that claims to be ethical. These portfolios should also shun as unethical the producers of intermittent and hence unreliable (“renewable”) energy. I value criticism. […]

The factual case for fossil fuels

In my previous wire (How we’ve prepared for the next bust, 28 November), I noted that recessions can have salutary effects: they usually damage and sometimes destroy the “conventional wisdom” which inflates the boom and bull market – and later collapses into bust and bear market. I demonstrated that “what everybody knows” at the height […]

How we’ve prepared for the next bust

My two most recent wires (Recessions usually crush shares – but investors can always reduce their ravages, 31 October and How low could stocks go in 2023? 14 November) established six key conclusions: Investors can’t accurately predict the timing, still less the duration or severity, of recessions. Nor, it’s hardly worth adding, can central bankers and economists. […]

How Low Could Stocks Go in 2023?

Shane Oliver believes that during the year to come Australia will likely avoid a recession (see, for example, Seven reasons why Australia should avoid a recession, 9 November). But it’s quite possible that it won’t: on 28 October in Shane Oliver’s guide to riding out a “year to forget” he reckoned that “the chance of recession in […]

Recessions usually crush shares – but investors can always reduce their ravages

According to Ashley Owen (“Recessions Are Usually Good for Sharemarkets,” Firstlinks, 12 October), “history shows that economic contractions have been mostly good for share prices.” Specifically, “the Australian share market has actually increased during the majority of economic recessions in Australia. The same is true for the U.S. share market during U.S. recessions.” In addition to […]

How the 60/40 portfolio outperforms

In Critics of the 60/40 portfolio have their blinkers on (27 September), David Thornton notes that “the age-old 60/40 portfolio,” comprised of 60% stocks and 40% bonds, “has copped a growing chorus of criticism lately.” On 15 October 2021, for example, Goldman Sachs asked: “is the 60/40 dead?” Barron’s was unequivocal. On 4 November, it titled its lead […]

Why ESG is fatally flawed

“The value of assets managed with a responsible investing framework has risen to $A1.54 trillion, accounting for 43% of the total (Australian) market,” The Australian reported on 12 September. In a survey it released that day, the Responsible Investment Association Australasia stated that $2.06 trillion of assets under management had been “self-declared as practicing responsible investment.” Tellingly, […]

Why Jerome Powell’s speech shouldn’t have surprised you

Jerome Powell chairs the Board of Governors of the U.S. Federal Reserve. His speech at the Fed’s Jackson Hole Symposium disappointed and even shocked many people. It’s been widely cited as the cause of plunges of between 3% and 4% in American markets on that day, as well as falls of almost 2% in Australia […]

Tech Stocks Outperform: Truth or Myth?

Do technology stocks generate better returns than non-techs? The conventional wisdom hints that they do. Business Insider (22 July 2022) encapsulates it: tech stocks “offer some of the best growth potential, but – like most high-reward investments – come with high risks too.” Mainstream financial theory underpins this inference. “A positive correlation,” says Investopedia, “exists between […]

Why inflation is and will remain high

Everybody knows that consumer prices in Australia, Britain, the U.S. and other countries have risen rapidly over the past year, and most investors know that they’re presently increasing at rates unseen in decades. But seldom does anybody ask: what is inflation? What, ultimately, causes it? And because they don’t ask these questions, the crucial one […]

Shun stock-pickers – choose investors

Ally Selby (How the #1 picks went from hero to zero in just 6 months, 12 July) reckoned that the January-March quarter was “tough, tiresome and damn it, sometimes terrifying.” April-June, she added, was even worse: “Only three out of Australia’s (18) finest stockpickers’ highest conviction calls are in the black, while the rest have slid […]

How experts’ earnings forecasts harm investors

It’s “an article of faith among Wall Street research departments,” wrote David Dreman in Contrarian Investment Strategy (1979): “nothing is as important in the practice of security analysis as estimating the earnings outlook … Forecasting is the heart of most security analysis as it is practiced today.” More than 40 years later, not just in Wall Street […]

Leithner & Co Preliminary Half-Year Report

Dear Leithner List Members, Linked below is the preliminary Half-Year Report, distributed to shareholders last week, summarising Leithner & Co’s operations and results for the six months to 30 June. Not just despite the market’s turmoil and volatility, but also because of it, our conservatism continues to produce strong and stable outcomes for our investors. […]

What ASX stocks would Warren Buffett buy in 2022?

t’s a common and constantly asked question: “what will Warren Buffett do next?” In the U.S., its answer has practical importance. If you’re a hedge fund or other asset manager and can read his mind, then buying what he subsequently acquires can generate considerable short-term profits. Of course, nobody can unerringly anticipate anybody’s actions. But […]

Investors beware: “Cheap” renewables are very expensive

For years, it’s not merely been conventional wisdom; it’s become a pillar of the zeitgeist and a litmus test of acceptable opinion: electricity generated from intermittent sources, particularly solar panels and wind farms, is much cheaper than baseload power from coal- and gas-fired plants. Respected sources underpin this orthodoxy. On 11 December 2020, for example, […]

Decarbonisation: A doubter’s guide for conservative investors

In December of last year, Livewire “surveyed more than 4,000 investors and learned that 62% of them intend to invest in decarbonisation in 2022. That was double the level of interest of any other megatrend.” Its latest Megatrends Series, Decarbonisation 2022, “unearths the funds, ETFs, and experts leading the charge to Net-Zero.” One contributor asserts: […]

America’s permanent recession: Is it coming to Australia?

It’s a never-ending ritual: many people hype current (and try to guess upcoming) national income statistics such as Gross Domestic Product – or heed those who do. The bigger is GDP and the more rapidly it rises, mainstream economists and policymakers strongly imply (and investors and journalists obediently accept), the healthier is the economy and […]

The janitor who amassed a fortune: How character underpins investment success

All investors want – or, at least, say that they want – to become successful. And virtually all people claim that they desire financial independence and wish to help others. How to achieve these worthy goals? In this article, which reviews the life and legacy of Ronald Read, a janitor, maintenance man and service station […]

Why you’re probably overconfident – and what you can do about it

Did January’s market corrections distress you? Do you worry that wobbles – or worse – will return? If so, perhaps that’s because you were and remain overconfident. You’d hardly be alone: in research it conducted last year, Morningstar found that two-thirds of Americans, a similar proportion of its financial advisers and 80% of its Generation […]

Will climate change soon make Australia “uninsurable”?

To many investors, it’s indisputable: a warming climate has caused the number and severity of natural disasters to increase. Moreover, this supposedly rising tide of devastation threatens Australians and their insurers. These claims are being repeated increasingly frequently and fervently, yet a glaring weakness accompanies them: they almost invariably lack credible – indeed, often any […]

Three risks you can discount – and one you can’t

This article summarises Leithner & Co.’s assessment of three key commonly-cited macro-economic risks: (1) increasing inflation, (2) stagnant or declining economic growth and (3) rising interest rates. By analysing a long series of data compiled mostly by Robert Shiller, I show that: In isolation, waning growth (as measured by Gross Domestic Product) as well as […]

The myth of the small cap premium

“There are lots of reasons why investors get excited about small stocks, particularly in Australia,” a global asset manager stated in a report published in 2017. These reasons include “the higher growth rates that smaller companies can achieve” and “the myriad of successful individual stock stories that abound.” Many people dream about – and some […]

Our approach to selling – and why we sold BHP

In 2015, Leithner and Company Ltd purchased shares of BHP. In June of this year, we sold them. Over these years, this investment generated an unexpected but gratifying compound rate of total return of almost 30% per year. Using it as an example, this article summarises our approach to selling investments. As a “buy-and-hold” investor, […]

Does CBA deserve its premium?

Why, particularly since the GFC, have Commonwealth Bank of Australia’s returns outpaced ANZ’s, NAB’s and Westpac’s? For decades, macro-economic conditions have affected each of the Big Four in much the same way; and since 2017-2018, in the wake of the findings of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, […]

Keynes as investor-speculator

John Maynard Keynes (the First Baron Keynes of Tilton, 1883-1946) is usually remembered as the author of The General Theory of Employment, Interest and Money (1936) and father of “Keynesian economics.” He was probably the most famous and influential economist of the past century, and (based upon the damage they wreaked in the 1960s-1970s and since […]

Australia’s dividend recession

In Five crucial facts the mainstream has ignored (23 April), I demonstrated that “Australian equities have entered an earnings depression – and the market has mispriced it … egregiously.” Earnings finance dividends; so what, in the midst of Australia’s bogus boom (19 May), are this depression’s implications for payouts? In this article I substantiate five more crucial facts. Collectively, they […]

Australia’s bogus boom

The “recovery” of Australia’s economy from last year’s plunge into recession is much more apparent than real. Before the pandemic, deep-rooted and growing impediments hobbled its growth. Some have existed for decades, others result from the poor policy during and since the GFC. And beginning in March of last year, politicians’ abandonment of even the pretence […]

Australia’s Earnings Depression

If you’ve been following the news – which, two of my recent posts concluded, is a mistake! – for the past six months or more, you’ll be forgiven for thinking that the earnings of ASX-listed firms are recovering and therefore that the market’s remarkable gains since March 2020 are “sustainable.” The truth is diametrically different. […]

Investors beware: “News” impairs your mental and physical wellbeing

In my previous wire, I showed that overconsumption of news misinforms investors and wastes their time. But that’s not all: in this article, I cite evidence that overconsumption – particularly of news’ online and broadcast variants – hinders thinking. It doesn’t just cause your investment returns to suffer: even worse, it also impairs your mental and […]

Why investors should ignore most “news”

Shareholders and others sometimes ask: “where do you get the information you need to invest?” In response, I say something like: “every business day I scan headlines in major financial publications in Australia, Britain, Europe and North America. As a rule, I ignore opinion pieces and prognostications about markets and the economy. But I skim […]

Why does your manager charge fees and pay salaries and bonuses?

In my previous wire, I highlighted a vital reality that hardly anybody has noticed (or, perhaps, wants to mention): remarkably few financial advisers, analysts, brokers, journalists, strategists and the like are financially independent. Few own sufficient investments to generate the stream of dividends, payments of interest or other income sources to finance their living expenses. Instead, […]

Are you a customer, client or partner?

It’s vitally important, yet hardly anybody has noticed it: remarkably few financial advisers, analysts, brokers, journalists, strategists and the like are financially independent. Few, in other words, own enough assets to generate a stream of income that finances their living expenses. Instead, they rely as heavily as the average adult does – that is, almost […]

Investors, beware: It’s THAT time of year again!

How important are rankings of managed funds’ results during the past 12 months? How should investors interpret them? In a key sense, rankings ARE important – but NOT in the way the mainstream assumes. At this time of year, and again at mid-year, when they come thick and fast, as an investor you should heed […]

Speculators are playing with fire; investors, don’t get burnt!

Earlier this month, a columnist at another Australian website encapsulated the exuberance that’s currently gripping stocks – and the incredulity that somebody mightn’t share it: “It’s difficult to be anything other than bullish on the prospects for equity markets next year. I know I am. I mean, what exactly is the bear case? Is there […]

Will Joe Biden be good for investors? Why I disagree with Geoff Wilson

Do investors in American – and, by implication, global – markets receive higher returns when Democrats occupy the White House? Over the past few months, several journalists, an eminent finance academic and a prominent Australian investment manager, among others, have contended – sometimes emphatically – that they do. Most recently, The Australian (1 December) quoted Geoff Wilson, […]

Experts can’t predict yet investors must plan: What, then, to do?

In financial markets, predictions are ever-present and unavoidable. Yet investors worthy of the name don’t allow forecasts, including those of experts, to determine – or even influence – their decisions. The evidence has long been compelling but is almost universally ignored: authorities generally don’t (because they can’t) provide reliable guides to the future. Indeed, the […]

Does high IQ make a better investor?

In a recent two-part series, I showed that successful investment isn’t a matter of raw brainpower; instead, it’s primarily the result of refined character – and particularly of Stoic disposition. This article elaborates two related points. First, high-IQ investors don’t outperform those of average intellect. Indeed, many people – regardless of their smarts – repeatedly […]

Investing lessons from Benjamin Graham

Benjamin Grossbaum entered this life in 1894 as a Briton; Benjamin Graham left it in 1977 as an American. He inherited Judaism but chose Stoicism. In his autobiography (Benjamin Graham: The Memoirs of the Dean of Wall Street, McGraw-Hill, 1996), he recalled that he “embraced stoicism as a gospel sent to him from heaven.” The […]

Successful investors are stoics – Part 1

What mindset underlies successful investment? How does an investor worthy of the name cope emotionally with sudden and sharp falls, as well as extended contractions, of individual stocks’ prices and market indexes’ levels? How does she prevent bull markets from inflating her ego and corroding her discipline? The answer to these questions is fundamental and […]

Two key amendments to Shane Oliver’s “9 keys to successful investing”

Shane Oliver’s recent article (9 keys to successful investing – and why they are more important than ever amid COVID, 15 October) summarises “nine key things for investors to bear in mind in order to be successful.” It contains plenty of common sense (which isn’t very common these days) and even some wisdom (which is […]

The pioneering investor you’ve never heard of

Henrietta Howland (“Hetty”) Green (1834-1916) exemplifies the practice of investment that Benjamin Graham pioneered in the 1930s, Warren Buffett has advocated since the 1950s and Leithner & Company has practised since 1999. She bought quality assets that others shunned – particularly during the financial crises that punctuated her career – and during bull markets, when […]

Why we need a “good” depression

Have you ever heard of the Depression of 1920-1921? In the U.S., where historical data are extensive, reliable and widely available, it was painfully sharp but mercifully short. According to the National Bureau of Economic Research, that country’s unofficial arbiter of the business cycle’s ups and downs, it commenced in January 1920 and ended in […]

Central banks don’t dispense “Stimulus” – they peddle poison

Do Low Rates of Interest Really Support Markets? On 10 September, I concluded that they don’t. This article explores one of this result’s major implications: investors can’t depend upon central banks. This is because their “stimulus” has produced artificially-low rates that are increasingly – and dangerously – divorced from reality. It’s possible, as the saying goes, that […]

Do low rates of interest really support markets?

Do today’s minuscule rates of interest justify stock markets’ sky-high valuations? Bulls often imply – and sometimes boldly assert – that they do, and mainstream theory is on their side. The problem is that theory is elegant and tidy, whereas reality is clumsy and messy: many factors, many of them fleeting and some of which […]

Why This Market Is 33-50% Overvalued

Are Australian stocks overvalued, fairly valued or undervalued? Leithner & Company, a value investor based in Brisbane, regularly analyses data that shed light upon this vital – and perennial – question. This article outlines some of the argument and analysis that supports my conclusion that the All Ordinaries Index is presently overvalued by at least […]

Leithner Letter No. 249-252

26 July-26 October 2020 In the closing passages of Elinor Ostrom’s Governing the Commons (1990) she states that the “intellectual trap” of much of … public policy is that scholars “presume that they are omniscient observers able to comprehend the essentials of how complex, dynamic systems work by creating stylized descriptions of some aspects of those systems.” […]

Leithner Letter No. 245-248

26 March – 26 June 2020 Some Americans have much higher income and wealth than others. Former President Barack Obama explained, “I do think at a certain point you’ve made enough money.” An adviser to Rep. Alexandria Ocasio-Cortez who has a Twitter account called Every Billionaire Is A Policy Failure tweeted, “My goal for this year is to get […]

Leithner Letter No. 241-244

26 November 2019 – 26 February 2020 [The U.S.,] and with it most of the Western world, is presently going through a period of inflation and credit expansion . As the quantity of money in circulation and deposits subject to check increases, there prevails a general tendency for the prices of commodities and services to […]

Leithner Letter No. 237-240

26 July – 26 October 2019 A senior U.N. environmental official says entire nations could be wiped off the face of the Earth by rising sea levels if the global warming trend is not reversed by the year 2000. Coastal flooding and crop failures would create an exodus of ″eco-refugees,” threatening political chaos, said Noel […]

Leithner Letter No. 233-236

26 March – 26 June 2019 “Here’s the truth, Brothers and sisters, there’s plenty of money in the world. There’s plenty of money in this city. It’s just in the wrong hands.” [So said New York City’s Mayor, Bill de Blasio, in his State of the City address on 10 January 2019]. American politics is […]

Leithner Letter Nos. 229-232

26 November 2018 – 28 February 2019 Ask yourself … what imprint will you leave in the sands of history? Did we take risks? Did we dare to defy expectations? Did we challenge accepted wisdom and take on established systems? … Or did we just go along with convention, swim down-stream so easily with the […]

Leithner Letter Nos. 226-228

26 August – 26 October 2018 The academic world is the natural habitat of half-baked ideas … You might think that the collapse of communism throughout Eastern Europe would be considered a decisive failure for Marxism, but academic Marxists in America are utterly undaunted. Their paycheques and their tenure are unaffected. Their theories continue to […]

Leithner Letter Nos. 222-225

26 April 2018 – 26 July 2018 California Governor Jerry Brown said legal rulings may clear the way for making cuts to public pension benefits, which would go against long-standing assumptions and potentially provide financial relief to the state and its local governments. Brown said he has a “hunch” the courts would “modify” the so-called […]

Leithner Letter Nos. 215-221

26 September 2017 – 26 March 2018 Alan Jay Levinovitz recently put forth the provocative argument that economics is The New Astrology. … The failure of the field to predict the 2008 crisis has also been well-documented. In 2003, for example, only five years before the Great Recession, the Nobel Laureate Robert E. Lucas Jr told the American […]

Leithner Letter No. 213-214

26 July 2017 – 26 August 2017 My impression is that “strategists” are very skilled at summarising and expressing current conventional wisdom, i.e., knowing what presently excites the herd. They don’t influence mass expectations, and still less do they create them: instead, they reflect them. … On average since the mid-1920s, the S&P 500 has […]

Leithner Letter Nos. 209-212

26 March 2017 – 26 June 2017 Let the directors of the [Second Bank of the United States] pursue their business on principles of Christian benevolence, and all will be well. Let them wind up the business of the Bank, without attempting to break down the government, … and it will die with the blessings […]

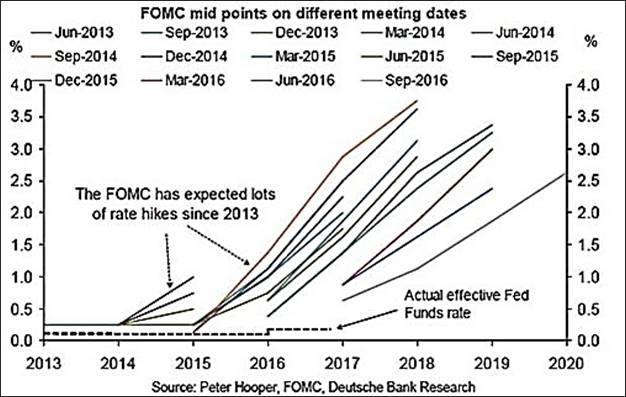

Leithner Letter Nos. 205-208

26 November 2016 – 26 February 2017 The FOMC has consistently overestimated future Fed Funds Rate (FFR) hikes. For a body that prides itself on super-scientific research methods and has teams of economists (self-described) and statisticians, it’s interesting that they can’t even predict their own behaviour. The graph is comical. These errors can be either […]

Leithner Letter Nos. 200-204

26 July – 26 October 2016 Nobel Prize winning economist and former vice-president of the World Bank, Joseph Stiglitz, praised Venezuela’s economic growth and “positive policies in health and education” during a visit to Caracas on Wednesday. “Venezuela’s economic growth has been very impressive in the last few years,” Stiglitz said … “President Hugo Chávez […]

Leithner Letter Nos. 196-199

26 March 2016 – 26 June 2016 … There cannot be any question of abolishing interest by any institutions, laws, or devices of bank manipulation. He who wants to “abolish” interest will have to induce people to value an apple available in a hundred years no less than a present apple. What can be abolished […]

Leithner Letter Nos. 192-195

26 November 2015 – 26 February 2016 We’re delaying a normalization of rates way, way beyond what is prudent. We have a monetary policy that’s now in place that was adopted for the crisis conditions of 2008 and 2009. This [northern] summer we’re going to be getting the seventh year of this recovery. It’s been […]

Leithner Letter Nos. 188-191

26 July 2015 – 26 October 2015 The special commodity or medium that we call money has a long and interesting history. And since we are so dependent on our use of it (and so much controlled and motivated by the wish to have more of it or not to lose what we have) we […]

Leithner Letter Nos. 184-187

26 March 2015 – 26 June 2015 analysis, Benjamin Graham, wrote in The Intelligent Investor in 1949: “The investor’s chief problem – and even his worst enemy – is likely to be himself.” … From financial history and from my own experience, I long ago concluded that regression to the mean is the most powerful […]

Leithner Letter Nos. 179-183

26 October 2014 – 26 February 2015 altogether even the pretence of teaching. … [More generally, English universities have] become sanctuaries in which exploded systems and obsolete prejudices found shelter and protection, after they had been hunted out of every other corner of the world. In general, the richest and best endowed universities have been […]

Leithner Letter Nos. 175-178

26 June 2014 – 26 September 2014 There’s a pattern of falsifying statistics throughout the entire [U.S.] Census Bureau. And anyone who attempts to blow the whistle on the fraud is either retaliated against or ignored, according to two new sources who have experienced the process firsthand. In [one] instance, a data collector … was faking reports that […]

Leithner Letter Nos. 171-174

26 February 2014 – 26 May 2014 I favour the policy of economy not because I wish to save money, but because I wish to save people. The men and women of this country who toil are the ones who bear the cost of the government. Every dollar we carelessly waste means that their life […]

Leithner Letter Nos. 167-170

26 October 2013 – 26 January 2014 In short, the delusion of paper riches is working as rapidly in England as it did in America. A young and inexperienced Minister, like a young and inexperienced Congress, may suppose that he sees mines of wealth in a printing press, and that a nation cannot be exhausted […]

Leithner Letter Nos. 163-166

26 July 2013 – 26 October 2013 During every preceding period of stock speculation and subsequent collapse there has been the same widespread idea that in some miraculous way, endlessly elaborated but never actually defined, the fundamental conditions and requirements of progress and prosperity have been changed, that old economic principles have been abrogated, … […]

Leithner Letter Nos. 159-162

26 February 2013 – 26 June 2013 recession. On Wednesday, Chairman Ben Bernanke declared that this has worked so well that the Fed must keep easing money for as long as anyone can predict in order to save a still-sputtering recovery. That’s the contradiction at the heart of the Fed’s latest foray into “unconventional policy,” […]

Leithner Letter Nos. 155-158

26 November 2012 – 26 February 2013 Is lying considered an appropriate mode of communication for euro-zone leaders? Asked whether deliberate misinformation would undermine the market’s confidence in future euro-zone pronouncements, [Guy Schuller, the spokesman for Luxembourg Prime Minister Jean-Claude Juncker, the man who is the head of the Eurogroup council of euro-zone finance ministers], […]

Leithner Letter Nos. 151-154

26 July 2012 – 26 October 2012 At the same time that China’s economy no longer benefits from these three favourable conditions, it must recover from the dislocations – asset bubbles and inflation – caused by Beijing’s excessive pump priming in 2008 and 2009, the biggest economic stimulus program in world history (including $1 trillion-plus […]

Leithner Letter Nos. 148-150

26 April 2012 – 26 June 2012 Is lying considered an appropriate mode of communication for euro-zone leaders? Asked whether deliberate misinformation would undermine the market’s confidence in future euro-zone pronouncements, [Guy Schuller, the spokesman for Luxembourg Prime Minister Jean-Claude Juncker, the man who is the head of the Eurogroup council of euro-zone finance ministers], […]

Leithner Letter Nos. 144-147

23 December 2011 – 23 March 2012 I consider economic laws comparable to natural laws, and I have just as much faith in the principle of the division of labor as I have in the universal law of gravitation. I believe that while these principles can be disturbed, they admit of no exceptions. “De la […]

Leithner Letter Nos. 140-143

26 August 2011 – 26 November 2011 alone for the reduction of the administration of our government to the genuine principles of its Constitution; I mean an additional article, taking from the federal government the power of borrowing. Thomas Jefferson Letter to John Taylor 26 November 1798 Credit expansion cannot increase the supply of real […]

Leithner Letter Nos. 136-139

26 April 2011 – 26 July 2011 re and from coal, but they are going to last for some time. I think that the prices of those goods, given the growth in Asia, given the demand in Asia, given the fact there’s a construction boom in Asia which will last for a long time. That […]

Leithner Letter Nos. 131-135

26 November 2010 – 26 March 2011 I am aware that many object to the severity of my language; but is there not cause for severity? I will be as harsh as truth, and as uncompromising as justice. On this subject, I do not wish to think, or to speak, or write, with moderation. No! […]

Leithner Letter Nos. 127-130

26 July 2010 – 26 October 2010 It would be irresponsible in the extreme for an individual to forestall a personal recession by taking out newer, bigger loans when the old loans can’t be repaid. However, this is precisely what we are planning on a national level.I believe these ideas hold sway largely because they […]

Leithner Letter Nos. 124-126

26 April 2010 – 26 June 2010 It would appear that the more liberty we lose, the less people are able to imagine how liberty might work. It is a fascinating thing to behold. People can no longer imagine a world in which we could be secure without massive invasions of our privacy at every […]

Leithner Letter Nos. 120-123

26 December 2009 – 26 March 2010 After nearly four months of frank, honest, and open dialogue about the failing economy, a weary U.S. populace announced this week that it is once again ready to be lied to about the current state of the financial system. Tired of hearing the grim truth about their economic […]

Leithner Letter Nos. 117-119

26 September 2009 – 26 November 2009 From the beginning of the current financial crisis, many officials have been insisting that a big part of our problem is “confidence.” Remember back [in October-November 2008] when the $700 billion bailout was supposed to inject “confidence” into the financial system? I can’t help but think of another […]

Leithner Letter Nos. 114-116

26 June 2009 – 26 August 2009 My arrival (very recently) at philosophical anarchism has disturbed some of my conservative and Christian friends … My fellow Christians have argued that the state’s authority is divinely given. They cite Christ’s injunction “Render unto Caesar the things that are Caesar’s” and St Paul’s words “The powers that […]

Leithner Letter Nos. 111-113

26 March – 26 May 2009 Private ownership of savings … can be socially controlled. The social abuses connected with savings are encountered mainly in the mechanics of investment and financial management by the large banks, savings institutions, and insurance companies which handle savings. It is a relatively easy matter for the State to preserve […]

Leithner Letter Nos. 108-110

26 December 2008 – 26 February 2009 The government’s policy [is creating] a short-term boom in housing. Like all artificially-created bubbles, the boom in housing prices cannot last forever. When housing prices fall, homeowners will experience difficulty as their equity is wiped out. Furthermore, the holders of the mortgage debt will also have a loss. […]